Golden Visa Investment Routes: Strategic Pathways to European Residency

Reading time: 13 minutes

Table of Contents

- Introduction to Golden Visa Programs

- Real Estate Investment Route

- Capital Transfer Options

- Business Investment Pathways

- Investment Fund Participation

- Comparative Analysis of Investment Routes

- Real-World Investor Journeys

- Common Challenges and Solutions

- Strategic Selection Framework

- Your Golden Visa Roadmap: Making the Optimal Choice

- Frequently Asked Questions

Introduction to Golden Visa Programs

Feeling trapped by geographical boundaries while your investment potential knows no limits? Golden Visa programs represent that rare intersection where wealth management meets lifestyle design—offering qualified investors a pathway to European residency through strategic capital deployment.

Golden Visa programs have transformed how global investors approach residency planning, creating doorways to European markets through various investment vehicles. Each pathway demands different levels of capital commitment, offers unique risk-reward profiles, and delivers distinct lifestyle benefits.

Let’s be clear: selecting the optimal Golden Visa investment route isn’t simply about meeting minimum thresholds. It’s about aligning financial strategies with long-term objectives—whether that’s portfolio diversification, generational wealth transfer, or securing future mobility options in an increasingly unpredictable world.

According to the Investment Migration Council, Golden Visa programs generated over €25 billion in direct foreign investment across Europe between 2010-2020, with Portugal, Spain, and Greece capturing significant portions of this capital flow. The question isn’t whether these programs work—it’s which investment route works optimally for your specific circumstances.

Real Estate Investment Route

Property Investment Fundamentals

Real estate remains the most popular Golden Visa investment route, capturing approximately 68% of all Golden Visa investments across European programs. Why? It combines tangible asset ownership with potential appreciation and rental yield—a trifecta of benefits that resonates with wealth preservation strategies.

The property investment threshold varies significantly by country:

- Portugal: €500,000 standard investment (€350,000 for rehabilitation projects in urban regeneration areas)

- Spain: €500,000 minimum investment

- Greece: €250,000 minimum investment

- Malta: €350,000 (properties in South of Malta or Gozo) or €300,000 (properties in Special Designated Areas)

Real estate offers what financial advisor Carlos Martins calls “sleep-well capital deployment”—investments you can physically inspect, potentially use personally, and leverage against market volatility. “The tangibility factor shouldn’t be underestimated in wealth planning,” notes Martins. “Particularly during periods of economic uncertainty.”

Risk-Return Considerations

Let’s talk straight about the property investment route: while it offers tangibility, it’s not without complexities. Key considerations include:

- Liquidity constraints: Most programs require maintaining the property investment for 5+ years, creating potential exit timeline challenges

- Location sensitivity: Returns vary dramatically between prime urban locations and peripheral areas

- Management overhead: Rental properties require ongoing administration, particularly challenging for remote investors

- Market cyclicality: Property markets experience significant boom-bust cycles that can impact returns

Real estate investor Ahmed K. shared his experience with Portugal’s Golden Visa: “The €350,000 rehabilitation route offered both entry into the program and revitalization tax benefits. However, construction delays extended my timeline by 14 months. The lesson? Factor timeline flexibility into any property-based Golden Visa strategy.”

Capital Transfer Options

Bank Deposit Pathways

Capital transfer options provide a straightforward alternative to property investment, typically involving direct transfers to government bonds, bank accounts, or approved financial institutions. These routes appeal to investors seeking administrative simplicity and capital preservation over aggressive growth.

The capital transfer approach offers distinct advantages:

- Minimal ongoing management requirements

- Clear, predictable administrative processes

- Reduced exposure to sector-specific risks

- Enhanced liquidity compared to real estate

Cyprus-based financial strategist Elena Dimitriou explains: “Capital transfer routes essentially simplify the Golden Visa equation. They’re particularly suitable for investors who prioritize program participation over maximizing investment returns, or those who already maintain diversified European investment exposure.”

Government Bond Investments

Government bond investments represent another capital transfer pathway, offering Golden Visa access through sovereign debt instruments. These routes typically require:

- Portugal: €1,000,000 in government bonds

- Spain: €2,000,000 in Spanish government debt

- Greece: €400,000 in government bonds

Bond-based pathways offer what investment advisor Marcus Chen calls “program participation with capital preservation intentions.” However, he cautions: “Given current yield environments, investors should view these primarily as residency acquisition vehicles rather than yield-generating assets. The true return manifests through mobility benefits rather than financial dividends.”

Quick Scenario: Consider Sophia, a technology entrepreneur seeking portfolio diversification alongside European mobility. “I evaluated real estate carefully but ultimately selected Portugal’s bond option. While the threshold was higher at €1 million versus €500,000 for property, the simplified exit strategy and reduced management overhead aligned better with my frequent travel schedule and existing property portfolio.”

Business Investment Pathways

Job Creation Models

Business investment models approach Golden Visa qualification through economic stimulus and employment generation rather than passive capital deployment. These pathways typically reward commercial venture creation that enhances local economic activity and employment.

Key business investment thresholds include:

- Portugal: €500,000 investment creating at least 5 permanent jobs

- Spain: Business project of “general interest” with job creation, innovation, or socioeconomic impact

- Greece: €400,000 investment in commercial operations

This route appeals particularly to active investors with operational expertise. Dr. Andrea Bernstein, entrepreneurship researcher at INSEAD, observes: “Business-focused Golden Visa pathways align governmental and investor interests more directly than passive options. They incentivize genuine economic contribution beyond simple capital deployment.”

Strategic Business Acquisition

Strategic business acquisition represents a variation on the business investment model, allowing investors to purchase existing commercial operations rather than creating new ventures. This approach offers immediate operational infrastructure while satisfying Golden Visa requirements.

Tech entrepreneur Marco Vitelli utilized this route for his Italian expansion: “Acquiring an established software development firm in Lisbon accomplished multiple objectives simultaneously—expanding our European operations while qualifying for Portugal’s Golden Visa program. The existing client base and local team accelerated our integration compared to building from zero.”

Pro Tip: Business investment routes require demonstrating commercial viability and economic impact beyond meeting investment thresholds. Prepare comprehensive business plans with market analysis, employment projections, and economic contribution assessments to strengthen your application.

Investment Fund Participation

Venture Capital Approaches

Investment fund participation emerged as an increasingly popular Golden Visa pathway, particularly for investors seeking diversified exposure to European markets through regulated investment vehicles. This route typically involves capital commitment to government-approved funds focusing on specific economic sectors or developmental objectives.

Notable investment fund thresholds include:

- Portugal: €500,000 in qualifying investment funds

- Greece: €400,000 in approved Greek investment funds

- Spain: No specific fund provision, but potentially qualifies under financial assets category

Investment fund participation offers what wealth strategist Jonathan Hayes terms “managed diversification with regulatory alignment.” He explains: “These funds combine professional management with government-approved investment themes, creating natural alignment between investor interests and national economic priorities.”

Private Equity Investments

Private equity investment represents a specialized category within fund participation options, focusing on growth-stage companies or specialized sectors like technology, healthcare, or sustainable energy. These investments typically feature:

- Higher risk-return profiles than real estate or bonds

- Active management by specialized investment professionals

- Longer commitment periods (typically 5-7 years)

- Potential for substantial appreciation through enterprise development

Maria Gonzalez, who utilized Portugal’s fund route, shares: “The fund option allowed me to delegate the investment management while maintaining Golden Visa eligibility. As someone without specific Portuguese market expertise, partnering with fund managers who understand local opportunities proved invaluable for both program compliance and investment performance.”

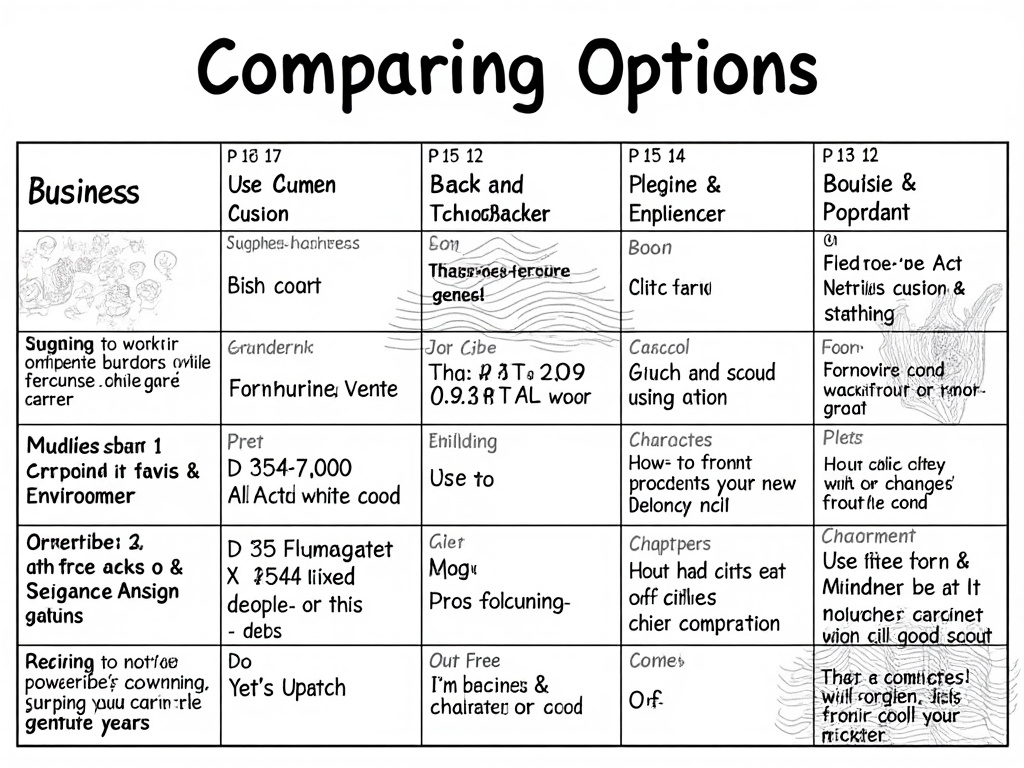

Comparative Analysis of Investment Routes

Let’s directly compare the primary Golden Visa investment routes across critical evaluation factors:

| Investment Route | Typical Entry Threshold | Liquidity Profile | Management Complexity | Potential Return |

|---|---|---|---|---|

| Real Estate | €250,000 – €500,000 | Low-Medium | High | Medium-High |

| Capital Transfer | €1,000,000 – €2,000,000 | High | Low | Low |

| Business Investment | €500,000 – €1,000,000 | Low | Very High | High-Volatile |

| Investment Funds | €350,000 – €500,000 | Medium | Low-Medium | Medium |

| Government Bonds | €400,000 – €2,000,000 | Medium-High | Very Low | Very Low |

Return Potential Visualization

Expected Return Potential by Investment Route

Average annual return estimates based on 2019-2023 performance data

This data reveals the fundamental tradeoff: higher return potential generally correlates with increased management requirements and reduced liquidity. Investment selection should align with your broader objectives beyond simply obtaining residency.

Real-World Investor Journeys

The Property Developer’s Approach

James Chen, a Singapore-based technology executive, opted for Portugal’s rehabilitation property route with a €380,000 investment in a historic building conversion project in Porto. His reasoning was multidimensional:

“I evaluated all available options against three criteria: residency security, capital appreciation potential, and personal enjoyment value. The rehabilitation project scored highest across these dimensions—offering program compliance, tax incentives on the renovation, projected appreciation in an emerging neighborhood, and a vacation property my family genuinely enjoys visiting.”

Chen’s experience highlights key considerations:

- He partnered with local legal specialists before property selection

- He built contingency funding for renovation cost overruns (which ultimately reached 22% above initial estimates)

- He established a local property management relationship for rental periods

- He conducted three site visits before finalizing the acquisition

Three years post-investment, Chen reports: “The property has appreciated approximately 19%, generates 3.8% net rental yield during periods we don’t use it personally, and our residency renewals have proceeded without complications. The additional time investment in due diligence proved essential to navigating local market peculiarities.”

The Fund Investor’s Strategy

Elena Petrov, a Moscow-based financial services professional, selected Greece’s investment fund option with a €400,000 placement in a regulated fund focusing on commercial real estate development. Her approach prioritized professional management and diversification:

“My primary expertise is in financial markets, not Greek property management. The fund route allowed me to leverage professional managers with local expertise while maintaining compliant participation in the Golden Visa program. Additionally, the fund’s portfolio spans multiple properties, reducing concentration risk compared to a single asset purchase.”

Petrov’s approach emphasized:

- Thorough fund manager due diligence, including performance history and regulatory standing

- Clear understanding of fee structures and performance incentives

- Verified alignment between fund investment timeline and Golden Visa holding requirements

- Quarterly reporting and governance mechanisms

Her assessment after two years: “The fund has delivered annualized returns of 6.2% while maintaining full program compliance. The professional management element has proven particularly valuable during market volatility, with managers able to make tactical adjustments I couldn’t have executed remotely.”

Common Challenges and Solutions

Navigating Regulatory Changes

Golden Visa programs exist at the intersection of investment and immigration policy—making them susceptible to regulatory evolution. Recent years have witnessed significant program modifications, including:

- Portugal’s 2022 elimination of residential property investments in high-density areas like Lisbon and Porto

- Greece’s investment threshold increase from €250,000 to €500,000 for properties in certain regions

- Spain’s increased scrutiny of source of funds documentation

Immigration attorney Sofia Vargas advises: “Regulatory risk represents an often underestimated factor in Golden Visa planning. Investors should build contingency strategies and timing flexibility, particularly if pursuing routes that show signs of potential regulatory adjustment.”

Strategic solution: Partner with advisors who maintain direct governmental relationships and can provide early indicators of potential policy shifts. Additionally, accelerate application timelines when considering investment routes showing signs of imminent change.

Balancing Investment and Lifestyle Goals

Many investors struggle to reconcile pure investment optimization with lifestyle preferences. This tension manifests particularly around property investments, where prime lifestyle locations often differ from optimal investment markets.

British entrepreneur Robert W. encountered this challenge with Spain’s program: “The analytics pointed toward Valencia for superior rental yields, but our family strongly preferred Barcelona for personal use. We ultimately selected Barcelona despite the projected 2.2% lower annual return because the lifestyle alignment enhanced the overall value proposition for our specific circumstances.”

Practical roadmap for resolving this tension:

- Clearly separate “must-have” program requirements from preference factors

- Quantify the financial impact of lifestyle-driven decisions

- Consider hybrid approaches (e.g., investment-grade property with selective personal usage)

- Evaluate whether multiple smaller investments could satisfy both objectives

Wealth advisor Tomas Kirchner suggests: “View Golden Visa investments through a blended return framework that incorporates both financial metrics and lifestyle utility. This approach often leads to more satisfying long-term outcomes than pure financial optimization.”

Strategic Selection Framework

Selecting the optimal Golden Visa investment route requires systematic evaluation across multiple dimensions. The following framework provides a structured approach to matching investment routes with personal circumstances:

Personal Factor Evaluation

Begin by assessing these critical personal factors:

- Investment timeline: How long do you intend to maintain the qualifying investment?

- Management capacity: What level of active oversight can you realistically provide?

- Risk tolerance: What volatility level aligns with your broader portfolio strategy?

- Personal usage intentions: Will you directly utilize assets like real estate?

- Exit strategy requirements: What liquidity profile do you require long-term?

Investment consultant Dr. Helena Rodrigues emphasizes: “Your Golden Visa investment shouldn’t exist in isolation from your broader wealth strategy. Integration with existing portfolio allocations, tax planning, and inheritance considerations should inform route selection.”

Program-Specific Considerations

Each Golden Visa program features unique characteristics that influence investment route suitability:

- Portugal: Offers the broadest range of investment options but with higher minimum thresholds for non-real estate routes

- Spain: Features higher investment requirements overall but provides access to Europe’s fourth-largest economy

- Greece: Provides the lowest real estate entry threshold but with more limited non-property options

- Malta: Combines investment requirements with donation components

Experienced Golden Visa consultant Maria Torres suggests: “The country selection and investment route selection should be viewed as interconnected decisions. The optimal investment pathway often emerges once you’ve narrowed your country selection based on residency requirements, tax implications, and personal preferences.”

Your Golden Visa Roadmap: Making the Optimal Choice

Beyond the analysis and comparisons, successful Golden Visa investment selection ultimately requires personalized alignment with your specific circumstances. Here’s your action-oriented roadmap for making the optimal choice:

- Clarify your primary motivation – Is residency the absolute priority, or are investment returns equally important? This fundamental question should guide your entire approach.

- Establish your investment ceiling – Determine not just what you can invest, but what you’re comfortable deploying in potentially less liquid structures.

- Articulate your time horizon – Most Golden Visa programs require maintaining investments for 5+ years. How does this align with your broader financial planning?

- Assess your management bandwidth – Be realistic about your capacity to oversee investments, particularly if considering active business or property options.

- Consult multi-disciplinary experts – The intersection of immigration, investment, and tax planning requires specialized expertise across all three domains.

Remember that the “best” investment route isn’t universal—it’s the one that optimally aligns with your specific circumstances, objectives, and constraints. As immigration investment advisor Carlos Ferreira notes: “The most successful Golden Visa investors approach the decision as part of integrated life planning rather than isolated transactions.”

Where will your Golden Visa journey lead? Perhaps the more important question is: what future are you designing, and which investment pathway most directly supports that vision? In a world of increasing mobility restrictions and economic uncertainty, strategic residency planning through thoughtful investment represents not just asset deployment—but freedom insurance for you and future generations.

Frequently Asked Questions

How do Golden Visa investment thresholds compare across European countries?

Investment thresholds vary significantly across European programs. Portugal’s program begins at €350,000 for rehabilitation properties, while Spain requires a minimum €500,000 property investment. Greece currently offers the lowest real estate entry point at €250,000 (with planned increases to €500,000 in certain areas). Cyprus previously required €2 million but has suspended its program. Malta combines investment requirements with contribution components starting around €600,000 total. These thresholds change periodically through regulatory updates, with the general trend toward increasing minimum requirements over time.

Can I finance my Golden Visa investment with a mortgage or loan?

Most Golden Visa programs require the qualifying investment amount to be introduced without financing for program eligibility. For example, if purchasing a €500,000 property in Portugal or Spain, that specific amount must come from personal funds without mortgage financing. However, some programs allow mortgages for amounts exceeding the minimum threshold. For instance, you might purchase a €700,000 property in Portugal with €500,000 in cash and €200,000 financed. The critical distinction is that the qualifying threshold must be introduced without leverage to satisfy program requirements. Always verify the latest regulations, as financing rules represent a common area for program modifications.

What happens to my Golden Visa status if I sell my qualifying investment?

Selling your qualifying investment before the minimum required holding period (typically 5 years) generally invalidates your residency status under the Golden Visa program. If you’ve already obtained permanent residency or citizenship through the program’s naturalization pathway, selling after this milestone usually doesn’t affect your status. Some programs offer reinvestment provisions, allowing you to sell and reinvest in another qualifying asset without losing status, provided there’s no gap in qualifying investment maintenance. Specific rules vary by country and may change over time, making it essential to consult with immigration counsel before considering any sale or replacement of Golden Visa qualifying investments.

Article reviewed by Henry Caldwell, Distressed Assets Specialist | Turning Risks into Opportunities, on May 15, 2025